Inflation and London hostel revenue

By Kelsey Fenerty, STR

The UK experienced 2.1% inflation in April 2019, a mere tenth of a percentage point over target rate and just below the 2.2% inflation averaged over the past 12 months. As inflation rises, revenue must grow in line or in excess to maintain purchasing power over time.

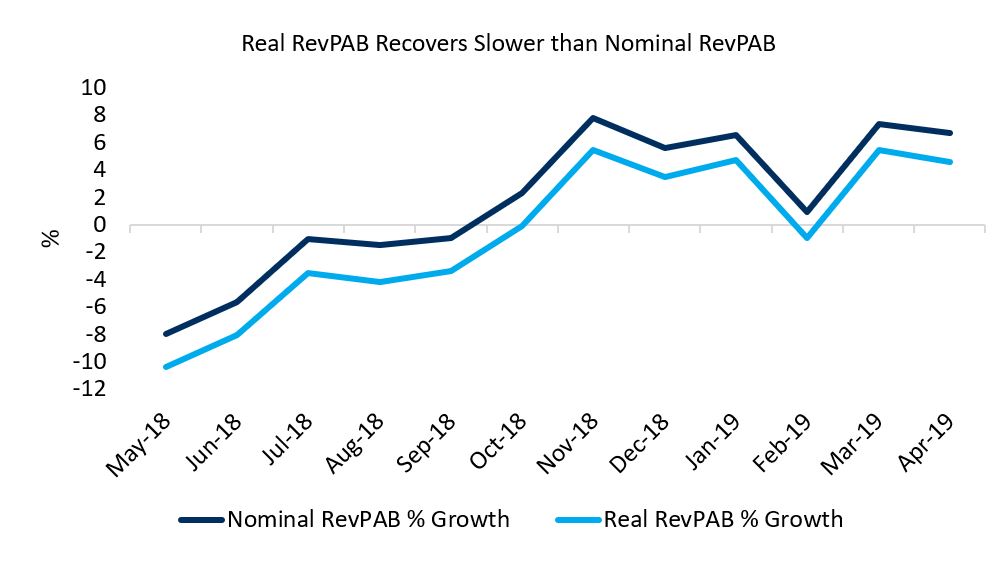

Nominal metrics are those determined at any given point in time; STR typically reports data in nominal terms. Real metrics account for rising price levels, or inflation, to more accurately compare metrics at two separate points in time. Real metrics that take into account inflation are vital to growing revenue and thus profit.

Below, we explore how London hosteliers fare in this regard, and how ancillary revenue might be a game changer.

Nominal metrics don’t always capture the whole story

Beds revenue in London hostels has grown well in excess of the Bank of England’s 2% inflation target in 2019, with April real revenue rising 7.0% year-over-year. Combined with an impressive 2.4% climb in occupancy to 85%, real Revenue per Available Bed (RevPAB) gained 4.6% from April 2018.

Strong nominal growth is necessary to maintain healthy real growth levels in excess of rising prices. RevPAB experienced more months with nominal growth than with real growth over the past 12 months, as both October 2018 and February 2019 saw RevPAB decline year-over-year when accounting for inflation.

The importance of Other Revenue

If pressed to name one advantage over hotels, hostels should pick ancillary revenue, or “Other Revenue” in STR terms. While comparable economy and midscale hotels are generally in the business of selling no-frills rooms, hostels offer a wide variety of optional add-ons that can contribute to guest experience while driving hosteliers’ bottom line. Combining Beds Revenue and Other Revenue provides Total Revenue, or all the revenue earned by a hostel regardless of source.

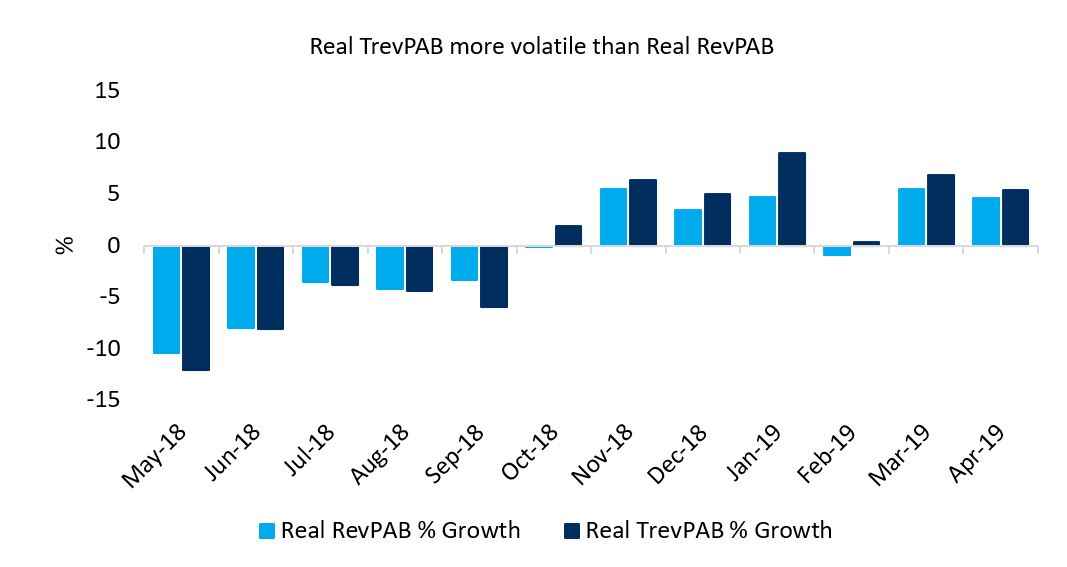

Other Revenue grew 12.1% from April 2018 when accounting for inflation, well above Bed Revenue’s respectable 7.0% year-over-year gain. This translated into real Total Revenue per Available Bed (TrevPAB) growth of 5.4%, just above real RevPAB’s gain of 4.6% from April 2018.

Real TrevPAB growing faster than real RevPAB is not a one-off occurrence. In expansionary periods, Other Revenue bolsters TrevPAB, driving growth in excess of RevPAB. During contractionary periods, as in mid-2018, Other Revenue experiences greater declines than Beds Revenue, and TrevPAB growth falls below RevPAB growth.

This works in hosteliers’ favor when the market performs well: TrevPAB was the first metric to reach positive year-over-year growth in real terms, adding 1.9% in October 2018 while real RevPAB still struggled at -0.1%.

Looking at TrevPAB in real terms allows for the most accurate hostel revenue picture possible, as it accounts for all sources of revenue and represents revenue growth outside of normal increases in price levels.

Summary

With inflation firmly in line with expectations, hostel revenue gains in excess of the target 2% are crucial for maintaining real growth. As the UK’s future remains in flux, looking at real growth will give a truer picture of how hostels perform year-over-year while accounting for external macroeconomic forces.

Interested in more?

STR reports on hostel performance in London and Amsterdam and is actively pursuing other markets. Reports are free to data providers. Interested in more information? Please contact Patrick Mayock at pmayock@str.com.

About STR

STR provides clients from multiple market sectors with premium, global data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. For more information, please visit str.com.