Next hostel hot spot – Miami?

By Kelsey Fenerty, STR

MIAMI – Despite the hostel industry’s ongoing evolution toward more stylish and sophisticated offerings that appeal to travelers of every ilk, the youth traveler – whether backpacker or gap year student – remains an important demand-driver for the sector.

Hoteliers are increasingly targeting these younger demographics as well. Over the past few years, several new hotel brands have launched in the US explicitly to appeal to the tastes of millennials and generation Z. Several existing brands, meanwhile, have simply adopted new marketing tactics to woo this growing cohort.

But whereas hostels have traditionally appealed to the more price-conscious youth, newer offerings from the hotel sector are carving out their space in the upscale and upper-upscale classes—and charging higher room rates to boot.

To further explore this trend and understand how it might complement hostel development in the US, we identified several brands that target millennials or gen Z via their own websites or other online marketing channels. We choose Miami, Florida as our case study, given the market plays host to a number of these youth-targeting brands as well as several hostel brands.

We identified the following seven youth-targeting brands in Miami:

- aloft

- AC Hotels by Marriott

- Hyatt Centric

- Nautilus by Arlo

- Generator

- Freehand

- Life House Little Havana.

The brands represent 15 total properties among them.

Notably, only one of the brands listed is in the midscale range, while all others fall in the upscale or upper-upscale classes. Three of these brands – Freehand, Generator, and Life House – offer shared hostel-style bunk bed accommodation in addition to traditional private rooms.

Performance

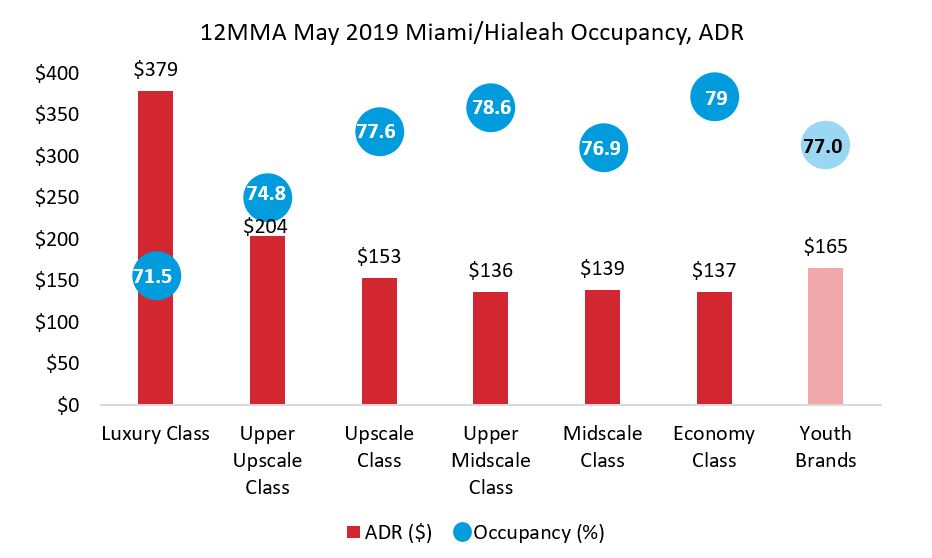

Miami/Hialeah, Florida is an expensive market: 19% of the market’s 58,000 rooms are categorized as luxury and an additional 45% are in the upper-upscale or upscale classes. As such, market ADR for the 12 months ending May 2019 was USD 199.08—compared to the total US average of USD 130.56.

Market occupancy is high, coming in at 76.1% in May 2019 on a rolling 12 month basis. The youth-oriented brands slightly outperformed the market average with occupancy of 77%.

ADR was nearly identical between upper midscale, midscale and economy hotels, with less than USD 3.00 difference in rate between the three classes. The similar rates in combination with high occupancies suggest there is appetite in the Miami market for budget-friendly accommodations.

Room for more?

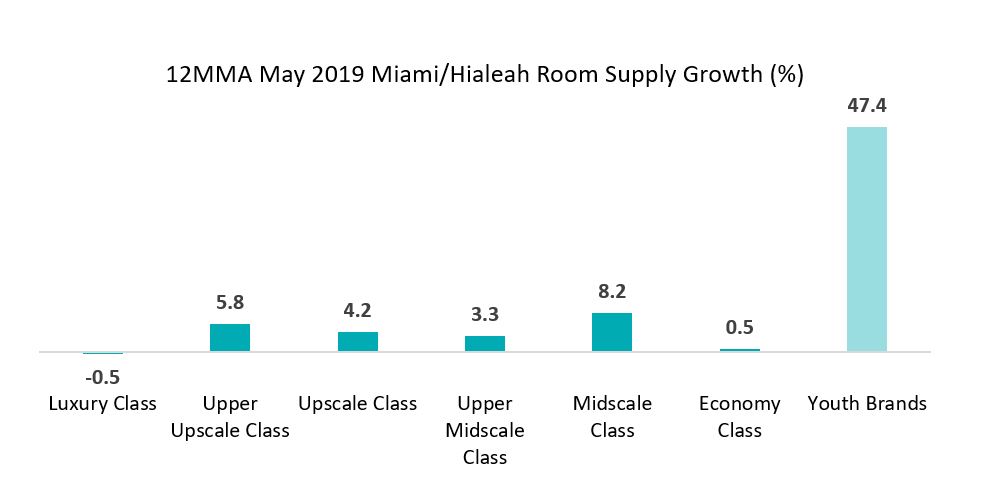

Miami supply growth reached 3.3% for the 12 months ending May 2019, led by an 8.2% rooms increase in the midscale class.

The youth-oriented brands we analyzed represented an additional surge in supply: five of the 15 properties studied opened in 2018 and one opened in 2019. Their spectacular growth – adding 47% to supply year-over-year – lends credence to their popularity with developers. That this cohort also sold more than three out of every four roomnights lends credence to their popularity with consumers.

The economy class also posted notable performance. This class achieved ADR similar to the midscale and upper midscale segments while achieving the highest occupancies in the market.

The data suggests that Miami has a strong appetite for both inexpensive accommodation and brands that cater specifically to younger travelers, which hostels may be well-placed to provide.

Interested in more?

STR reports on hostel performance in London and Amsterdam and is actively pursuing other markets. Reports are free to data providers. Interested in more information? Please contact Patrick Mayock at pmayock@str.com.

About STR

STR provides clients from multiple market sectors with premium, global data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. For more information, please visit str.com.