STR’s comparative analysis of Berlin’s accommodation sector

By Kelsey Fenerty

Germany is the birthplace of hostels, so it should be no surprise that its capitol city, Berlin, is a haven for backpackers, with roughly 100 hostels and some of the best-known. Economy and midscale hotels provide competition, accounting for 44% of Berlin’s 73,000 hotel rooms.

Berlin basics

Hostels in Berlin enjoy relatively high bed occupancy year-round, averaging 74.7% for the 12 months ending June 2019 and an average daily rate (ADR) of €21.81 over the same time period. Revenue per available bed (RevPAB) averaged €16.29 on a rolling 12 month basis, and other revenue pushed total revenue per available bed (TrevPAB) to €19.80.

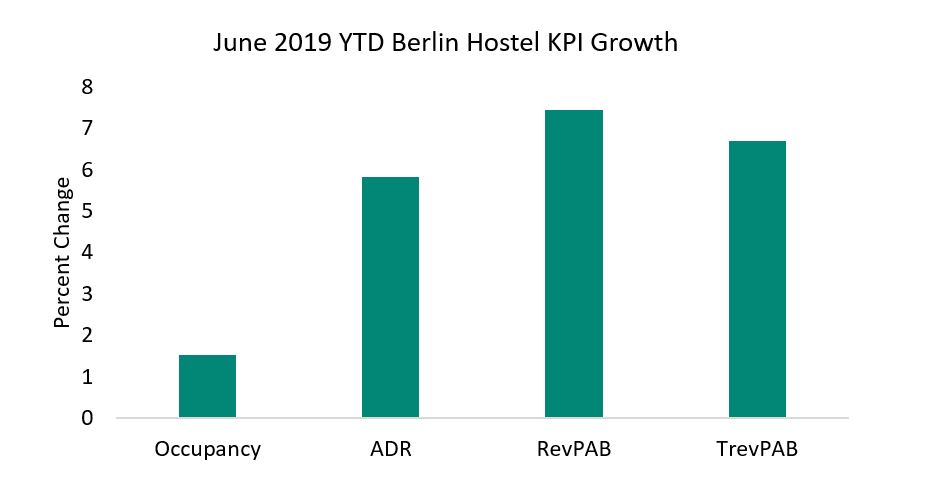

With demand growing 5.9% year-over-year, all four KPIs experienced considerable growth for the 12 months ending June 2019.

Hostel market comparison

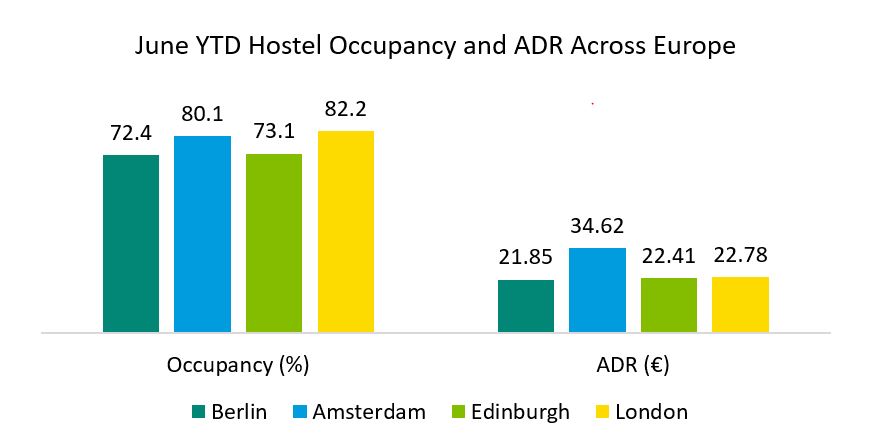

Berlin hostels slightly underperform when compared to other European cities. The market averaged 72.4% occupancy over the past six months, close to Edinburgh occupancy but more than seven percentage points below Amsterdam and London. Rates appear more equitable, with Amsterdam standing head and shoulders above the other three markets.

Other Revenue grew slower than Bed Revenue, leading to slightly lower but no less impressive 6.7% growth in TrevPAB. This suggests that Other Revenue may be “stickier” than Bed Revenue: prices for ancillary services may be less frequently adjusted, or guest demand for these services may be more inelastic.

Only London has reported similar gains in performance year-over-year. The UK capital city’s RevPAB increased 7.9% and TrevPAB grew 9.0%. Notably, TrevPAB grows faster in London than in Berlin; London hosteliers may be quicker to adjust their auxiliary service pricing.

Amsterdam and Edinburgh hostels increased occupancy and lost ADR year-over-year, leading to minimal RevPAB movement year to date. Occupancy growth was nearly identical between the three markets, with Amsterdam hostels increasing 1.4% year-over-year to Berlin’s 1.5% and Edinburgh’s 1.6%. However, Berlin easily outperformed Amsterdam and Edinburgh in all revenue-based metrics.

Berlin Hostels vs Hotels

Strong growth appears to be a market-wide phenomenon: economy and midscale hotels in Berlin grew occupancy 5.6% and rate 4.0% from June 2018, leading to a jump in revenue per available room of 9.8%. (STR tracks hotels on a per-room basis).

The high occupancy growth led to hotel occupancy of 75.9% year-to-date, nearly four percentage points higher than hostel occupancy over the same time period. Fortunately for hostels, economy and midscale hotels in Berlin are significantly more expensive, with year-to-date ADR of €71.21.

Summary

While other hostel markets may be struggling with year-over-year growth in the face of local macroeconomic factors, Berlin hostels are sailing through 2019. The market has increased rate almost 6.0% from this time last year while still driving occupancy nearly 2.0%. Similar growth in the economy and midscale class hotel segment suggests the market may be growing in popularity with the budget travel community.

Interested in more?

STR reports on hostel performance in London and Amsterdam and is actively pursuing other markets. Reports are free to data providers. Interested in more information? Please contact Patrick Mayock at pmayock@str.com.

About STR

STR provides clients from multiple market sectors with premium, global data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. For more information, please visit str.com.