COVID-19 and European accommodations performance

Kelsey Fennerty, STR

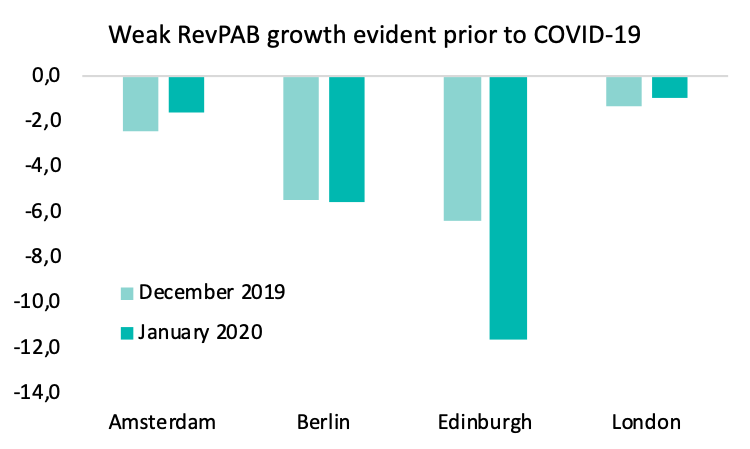

January data for hostels and most hotel markets in Europe was not impacted by the outbreak of coronavirus (COVID-19). While January hostels lost RevPAB year over year, the decline was similar to that experienced in December 2019, suggesting that this decline is part of a general industry slowdown and not virus-related.

As we wait to process February hostel performance data, we can look to hotel daily data for a preview of what the hostel industry might face over the coming months. Hostel performance is tracked at the monthly level, but STR tracks hotel performance at the daily level, allowing for preliminary February insights as to how the virus is affecting the industry.

European hotel performance impacts

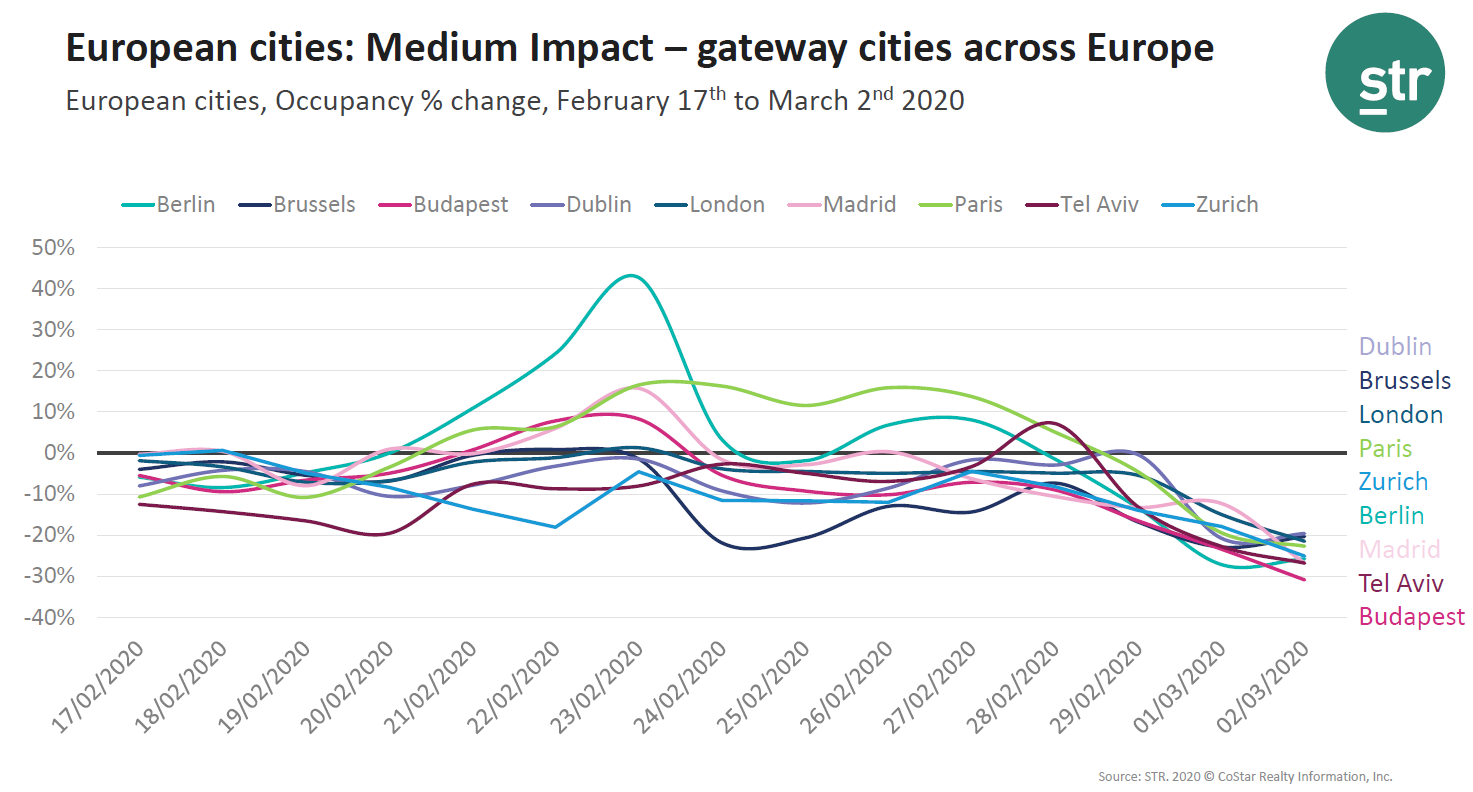

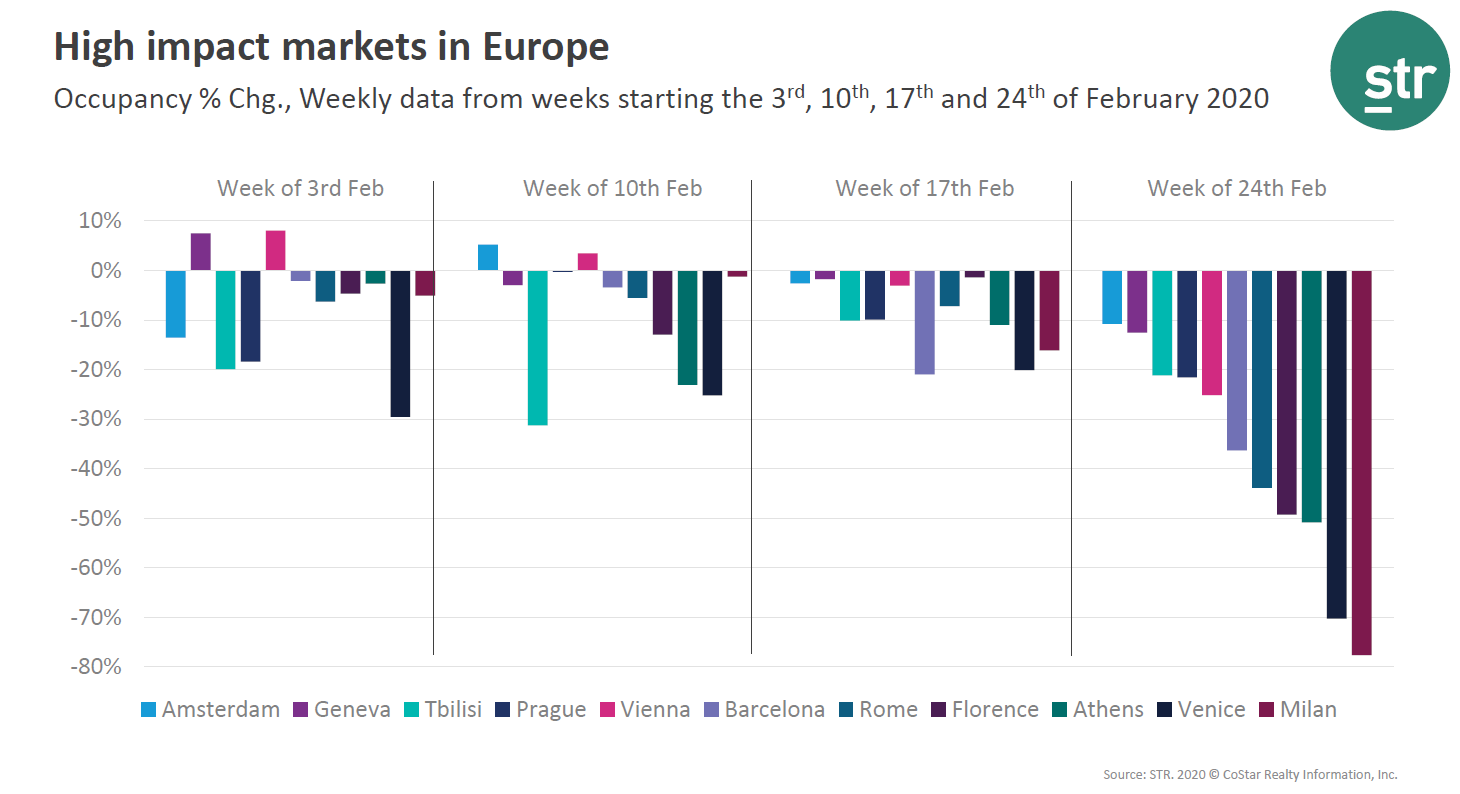

Postponed and cancelled events, such as Barcelona’s Mobile World Congress, marked the first significant impact of COVID-19. Additionally, airport hotel performance in major international markets such as Paris, Rome, Amsterdam and London started to show signs of the impact in mid-February.

Despite the lack of government guidance or travel bans in some countries outside of China, many companies started in February to suspend international and in some cases domestic business travel; these corporate travel bans have affected total market performance in addition to hotel airport performance.

Year-over-year occupancy change in gateway cities across Europe has trended downward since February 28. March 2, the first business day after many of the travel suspensions, marked occupancy declines between 20-30% for these nine markets.

Markets with a high case number of postponed/cancelled events experienced much more significant impacts to occupancy, with Venice and Milan losing upwards of 70% of prior year occupancy as significant government measures were put in place to combat the COVID-19 spread in Italy.

Looking ahead: Hotel business on the books

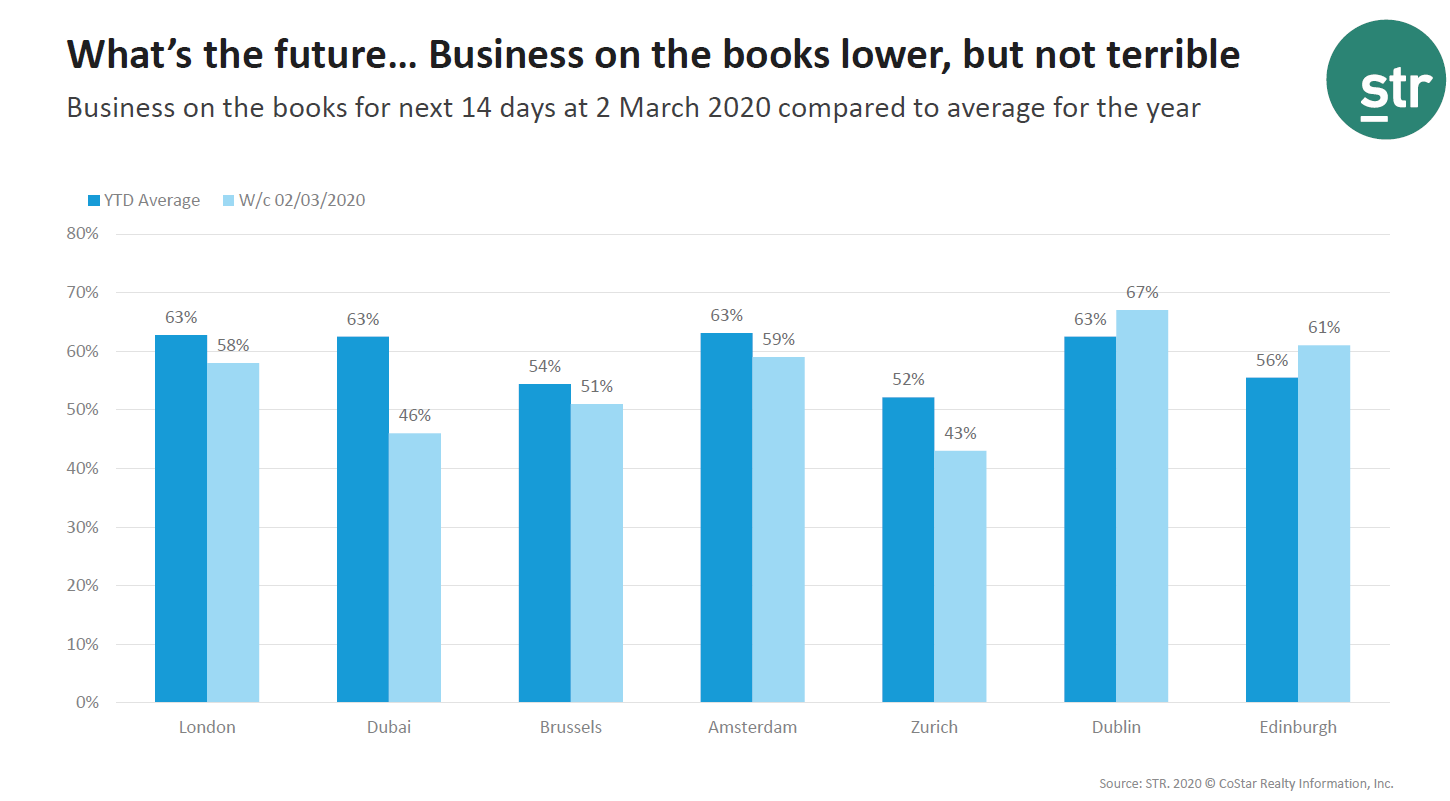

Using business on the books, we can take a look ahead to see how the future might play out.

In many markets, business on the books is down for the next 14 days in comparison to the year-to-date average. Exceptions are Dublin and Edinburgh, where there is some expectation that events in the calendar will still occur.

Business on the books does reflect event cancellation or postponement, but actual performance may not align with bookings.

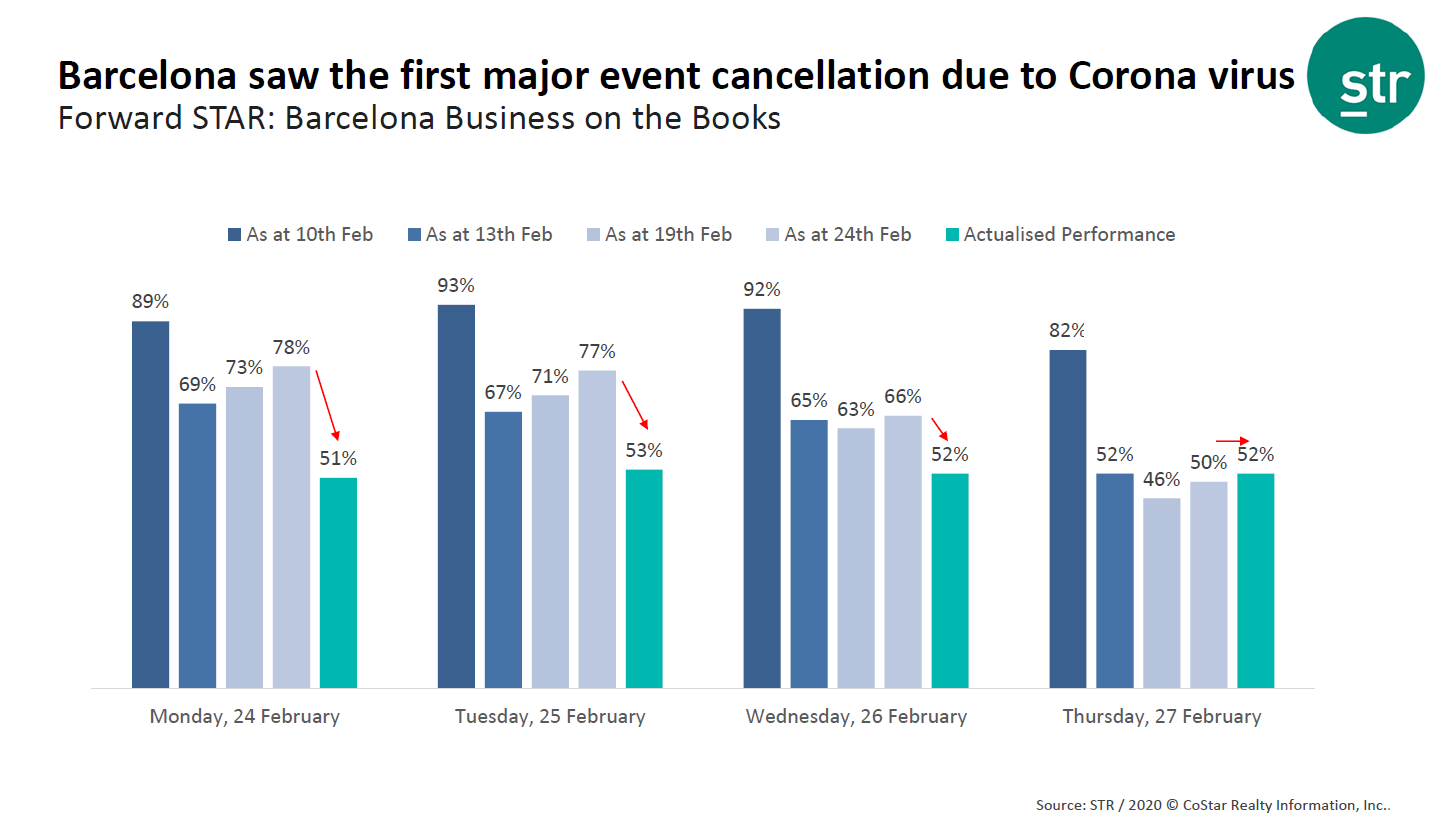

One day following the Mobile World Congress cancellation, Barcelona business on the books dropped significantly before increasing somewhat over the next eleven days. Much of this business, however, did not materialize, and performance during conference days was much lower than business on the books suggested.

As many bookings may not have cancellation abilities, this should not be surprising, and it is important to recognize that many bookings may not actually turn up when events are cancelled or postponed.

Conclusions

Coronavirus has and will continue to impact the accommodations industry, although the constantly evolving situation makes anticipating those impacts difficult. While China and Chinese outbound markets have experienced the most severe impacts, the effects of COVID-19 are spreading as the virus spreads, with Europe and the Middle East experiencing impacts borne of reduced travel.

The speed at which the virus is controlled will affect industry recovery. Based on the industry response to SARS in 2003, the rebound is likely to be sharp once containment occurs.

Data remains paramount to understanding the effects of the virus. Rather than benchmarking your performance to prior year performance, compare your property to market performance and take appropriate operational actions to reduce risk.

Interested in More?

STR has created a dedicated landing page https://str.com/data-insights-blog/coronavirus-hotel-industry-data-news for all hotel performance analysis around COVID-19.

For more information regarding the hostel industry, please contact Patrick Mayock at pmayock@str.com.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com

Join WYSE Travel Confederation

If you’d like to join WYSE Travel Confederation and benefit from new connections, free access to industry research, informative webinar sessions, discounts on industry events and brand exposure within the youth and student travel industry, click below to view our membership options and find out more.